Mining is a lucrative business for those who can procure the necessary hardware and operate in a cost-effective location, allowing them to generate consistent profits. The key advantage of a mining location is always low energy costs. In this regard, Europe—especially Germany—is at a significant disadvantage, as high electricity prices make mining unprofitable. Compounding this issue is a paradigm shift: until 2019, it was common to launch new blockchains that required their own mining infrastructure. However, with smart contracts enabling the creation of various token-based projects without the need for a separate blockchain, demand for new mining networks has decreased. Alternatively, founders can develop a Proof-of-Stake blockchain, which also eliminates the need for miners.

Table of contents

Nevertheless, there are business models that promise investors substantial returns by investing in mining. In this article, we will take a closer look at how these schemes work, why they usually fail, and why many of them are simply scams.

What is cloud mining?

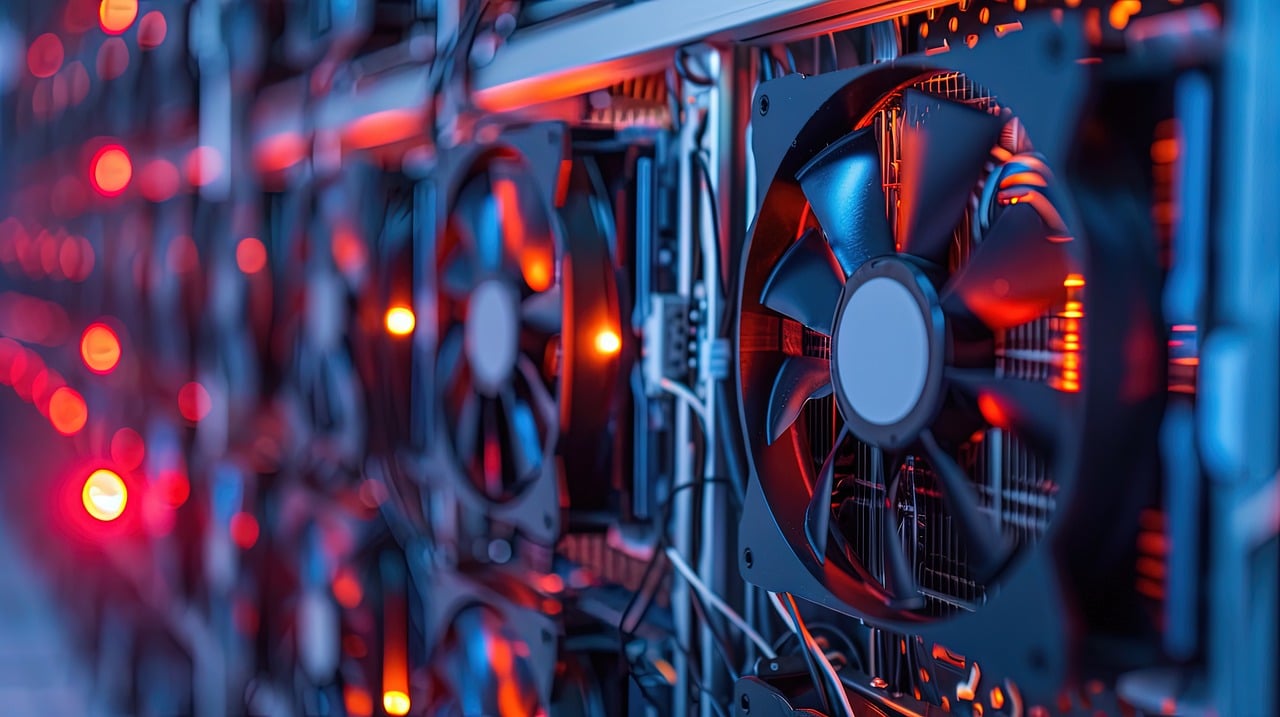

Cloud mining is a process in which individuals or companies mine cryptocurrencies like Bitcoin or Litecoin without directly owning or maintaining the necessary hardware. Instead, they rent or purchase computing power from a third-party provider that operates mining farms in data centers. These mining service providers handle hardware maintenance, power supply, and all other technical requirements needed for mining.

The main advantage of cloud mining is that it allows users to participate in the mining process and receive a share of the rewards without having to invest in expensive hardware or worry about its maintenance. Users typically pay a fee for the service, which is deducted from their earnings, thereby reducing their net returns.

There are different types of cloud mining contracts, including:

- Hosted Mining: The customer buys or leases mining hardware that is hosted in the provider's data center.

- Virtual hosted mining: The customer rents a virtual private server (VPS) and installs their own mining software on it.

- Performance-based mining: The customer buys a certain amount of hash power (measured in hashes per second) that does not relate to specific physical hardware.

While cloud mining can be an accessible way for individuals to participate in mining, it also carries risks. The industry is notorious for its susceptibility to fraud and scams, with some providers promising unrealistic returns or not operating any actual mining operations at all.

How does cloud mining fraud work?

Cloud mining fraud can operate in various ways, with scammers exploiting people's interest in generating easy returns. Since mining farms are almost always located abroad, verifying providers' claims is difficult. These sites are predominantly found in Asia, Russia, Kazakhstan, and, in some cases, the United States. Fraud can take place through different schemes. Here are the most common methods we frequently encounter in practice:

- Ponzi or snowball systems: Providers promise high returns from mining profits, which are actually paid out using the deposits of new customers rather than from real mining operations. When no new investors can be recruited, the system collapses, and most participants lose their money.

- Non-existing locations: Some scammers claim to have large mining farms and sell mining contracts without actually owning any mining hardware or infrastructure. They may use fake data or images to support their claims.

- Exaggerated promises of returns: Scammers lure investors with unrealistically high daily or monthly returns that are not sustainable in the real world of mining. Such promises are often a red flag for fraud.

- Hidden fees and conditions: Some cloud mining services have hidden fees or clauses in their contracts that significantly reduce users' payouts. Investors may realize too late that their expected earnings are being eaten up by fees.

- Lack of transparency: Reputable cloud mining providers are usually transparent about their operating locations, the hardware used and the actual mining yields. Fraudulent providers, on the other hand, often avoid disclosing specific information or use falsified data.

- Impossibility of payment: In some cases, users can see their alleged earnings on the platform, but when they try to withdraw them, they encounter obstacles, delays or are completely ignored, suggesting that the earnings never existed.

- False reviews and testimonials: Fraudulent providers can use fake reviews and testimonials to artificially boost their reputation and attract more victims.

Over the years, there have been several high-profile cloud mining scams that have permanently shaken confidence in this part of the industry. Fraudsters have also taken advantage of the growing interest in cryptocurrencies and the promise of quick profits to lure unsuspecting investors.

One of the best-known cases was Bitconnect, a platform that not only functioned as a lending platform but also offered cloud mining services. Bitconnect lured investors with exceptionally high daily returns, which ultimately turned out to be part of a Ponzi scheme. When the system behind Bitconnect collapsed in 2018, it is estimated that investors lost over USD 1 billion.

Another example is the HashOcean platform, which claimed to be a cloud mining company and promised high returns. After paying out operating costs and alleged profits over a long period of time, HashOcean suddenly disappeared in 2016, leaving its users without the promised returns and with significant losses.

CryptoMining.Farm is another case where investors were lured in with promises of guaranteed returns and virtual mining contracts. The platform offered lifetime contracts with no maintenance fees, which seemed unrealistic given the real costs and dynamics of the mining market. Many users reported that they never received their investments back, which made the platform suspected of fraud.

These examples highlight the risks associated with cloud mining and investing in cryptocurrencies if not adequately researched. They show how fraudsters exploit the lack of regulation and the anonymity of the internet to orchestrate complex fraud schemes that can lead to significant financial losses for investors.

How can you protect yourself from cloud mining scams?

Before deciding on a cloud mining service, it is crucial to carry out thorough research. The credibility of the provider should be checked by reading reviews and testimonials from other users. Warning signs such as unrealistic promises of returns, lack of transparency regarding the operating locations and the mining hardware used should not be ignored. It is also important to read the terms and conditions carefully before signing a cloud mining contract. The term of the contract, the costs, the expected return and possible fees should be set out transparently and formulated in an understandable way.

Reputable cloud mining providers offer trial contracts or packages that allow you to test the service before making any major investments. These offers are a promising way to evaluate the performance and reliability of the respective service. It is also advisable to diversify investments and not invest everything in a single cloud mining project. By diversifying investments, the risk can be reduced. It is generally advisable to only invest as much money as you are prepared to lose. This protects you even if you are disappointed by the provider despite thorough due diligence.

Discussions with other users in forums and on social media platforms can provide valuable insights and warnings about fraudulent providers. A reputable provider should also offer responsive and helpful customer support. Be skeptical of providers that use aggressive marketing tactics, such as promising guaranteed profits or offering bonuses for recruiting new customers. Such practices are often characteristic of pyramid schemes. Affiliate programs, on the other hand, should not be a deterrent, as these are standard market practice.

My cloud mining provider has defrauded me, what can I do?

If you need help in preparing a criminal complaint or want to identify the perpetrators and their traces using blockchain forensics, you should definitely get in touch with Crypto-Tracing. In cases of cloud mining fraud, this forensic evidence is invaluable because the perpetrators' transactions are uncovered. We close the gaps that authorities are unable to close for various reasons. We work in close cooperation with lawyer Marc Maisch, who specializes in crypto fraud and is happy to advise you on all legal issues.

Through targeted investigations, the collection and documentation of evidence, and support in filing a criminal complaint, the chances of effectively prosecuting the perpetrators increase. Contact us today through our form, and we will get back to you promptly to discuss the next steps in person.

FAQ on the topic of cloud mining fraud

How can you recognize reputable cloud mining providers?

Reputable providers are transparent with regard to their company data, contract conditions and offer realistic returns.

Are profits from cloud mining taxable?

In many countries, profits from cryptocurrencies are subject to tax. It is advisable to consult a tax advisor. In Germany, income from cloud mining is also considered taxable, but this does not apply to income from regular mining.

How common is cloud mining fraud?

Unfortunately, cases of fraud are not uncommon in the fast-growing and poorly regulated crypto industry. In the case of cloud mining, they are the rule rather than the exception. After all, the perpetrators only need to create a convincing website and claim to have mining equipment.

How can I check whether a cloud mining provider actually owns the mining equipment?

Ask for evidence such as photos or videos of the mining facilities and check whether the provider provides transparent and comprehensible information about its infrastructure. In case of doubt, it is possible to be deceived here too, but the perpetrators usually shy away from the effort. You should also check the information provided online independently if possible.

Is there a way to verify the authenticity of reviews and testimonials on cloud mining websites?

Look for independent review platforms or forums where real users share their experiences and be skeptical of websites that only have positive reviews. In principle, such review profiles can also contain false information, but the probability is lower. In addition, victims of fraud are guaranteed to speak up on such platforms.

What is the difference between cloud mining and mining pools?

With cloud mining, you rent computing power from a provider, while with a mining pool you join forces with other miners to share the computing power and distribute the rewards. In the second case, you have to own and operate the hardware yourself.